Every year, thousands of startups with brilliant ideas never make it past the first investor conversation. Not because the idea is bad. Not because the founders lack passion. But because the idea is not investable in its current form.

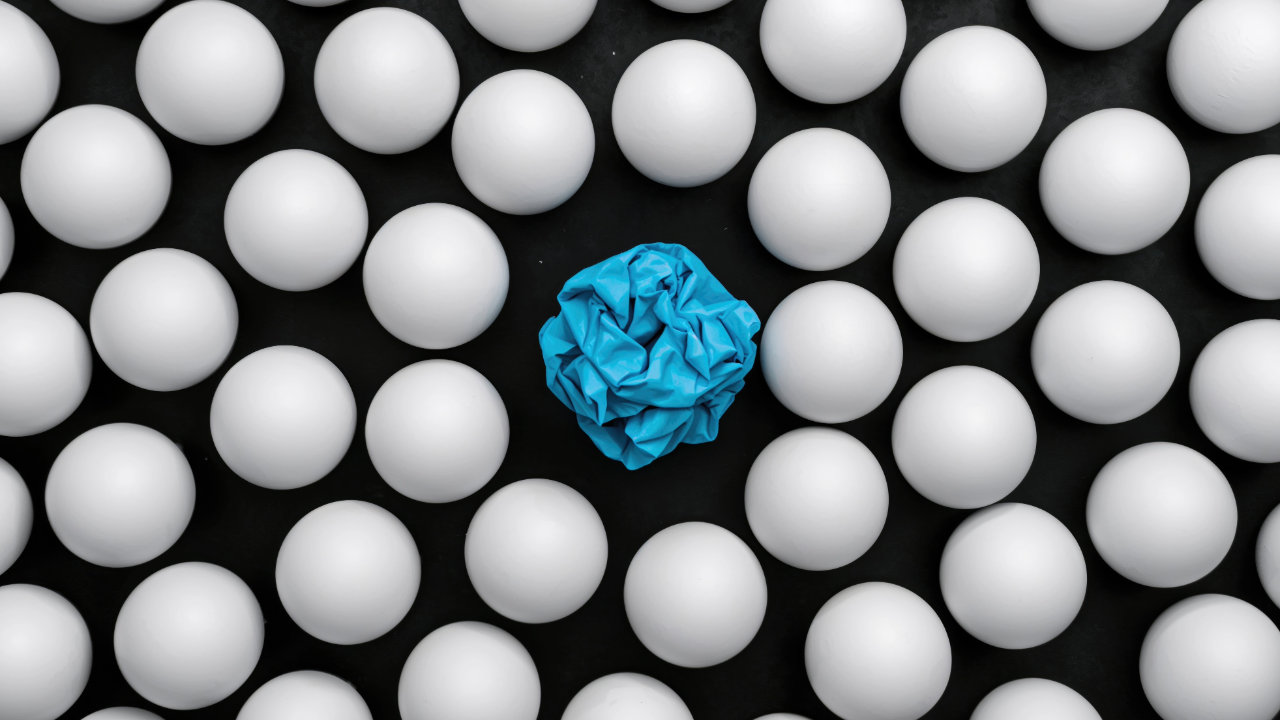

In today’s funding landscape, creativity alone is no longer enough. Investors are increasingly surrounded by idea-rich but documentation-poor startups — and that imbalance is changing how decisions are made.

The hard truth?

Great ideas fail when they aren’t translated into investor-ready documentation.

🚨 The Rise of “Idea-Rich but Uninvestable” Startups

We’re living in an era where:

- Tools make building MVPs faster than ever

- AI can generate pitch decks in minutes

- Founders can launch ideas with minimal upfront cost

Yet paradoxically, investor rejection rates are rising.

Why?

Because while ideas have become cheaper to create, clarity has become more valuable than creativity.

Investors aren’t short on ideas — they’re short on:

- Clear opportunity mapping

- Evidence-based assumptions

- Structured risk understanding

- Decision-ready documentation

An idea that lives only in a founder’s head — or inside a glossy pitch deck — is no longer enough to justify time, capital, or trust.

📉 Why Pitch Decks Alone No Longer Work

Pitch decks were once the gateway to funding. Today, they’re just the opening slide, not the decision driver.

Modern investors see pitch decks as:

- A conversation starter — not proof

- A vision summary — not validation

- A narrative — not a risk assessment

What’s missing?

Pitch decks typically don’t:

- Show how assumptions were tested

- Explain why a market opportunity exists now

- Detail operational feasibility

- Map risks and mitigation strategies

- Demonstrate structured thinking beyond storytelling

In short: pitch decks explain what you want to build — not whether it should be funded.

🔍 What Investors Actually Look for Before Meetings

Most founders assume investors decide during meetings.

In reality, decisions begin long before the call is booked.

Before agreeing to a meeting, investors increasingly want:

- Clear problem definition backed by data

- Market validation beyond surface-level research

- Competitive positioning that shows awareness, not arrogance

- A realistic execution roadmap

- Evidence that risks have been identified — not ignored

This is where many startups lose momentum.

Not because the idea isn’t exciting — but because it isn’t documented well enough to be trusted.

💸 The Hidden Cost of Undocumented Assumptions

Every startup is built on assumptions. That’s normal.

What’s no longer acceptable is leaving those assumptions undocumented.

Undocumented assumptions lead to:

- Misaligned investor expectations

- Delayed due diligence

- Rejected follow-up conversations

- Lost credibility

- Wasted months chasing the wrong feedback

From an investor’s perspective, undocumented assumptions signal:

“This founder hasn’t thought deeply enough about risk.”

And risk — not competition — is the real reason investors say no.

🧠 Investor Readiness Is Not a Pitch — It’s a Process

This shift is exactly why investor readiness has become a discipline of its own.

At MP Nerds, investor readiness is not about making things look good — it’s about making them make sense.

We help founders move from:

- Ideas → structured opportunities

- Opinions → documented insights

- Vision → investable clarity

Through our Investor Readiness Solutions, we focus on:

- Translating raw concepts into decision-ready documentation

- Structuring ideas the way investors think — not founders hope

- Building confidence through clarity, not hype

🔬 A Soft Introduction to the INVEST Framework

At the core of how MP Nerds works is our INVEST Framework — a structured approach designed to answer the exact questions investors care about.

Without overwhelming founders, the framework ensures:

- Idea validation grounded in evidence

- Needs and market fit clearly articulated

- Viability assessed realistically

- Execution mapped logically

- Strategy aligned with growth and risk

- Transparency across assumptions and decisions

The goal isn’t complexity — it’s confidence.

Because when documentation is clear, conversations change:

- Meetings become strategic

- Feedback becomes actionable

- Investors engage seriously

🚀 Why This Matters Now More Than Ever

Investors are not investing less — they’re investing more selectively.

In a crowded startup ecosystem, the winners aren’t always the most creative. They’re the most prepared.

Ideas don’t fail because they’re bad.

They fail because they’re not ready to be believed.

🔗 Further Reading & Industry Insight

For readers who want to explore this shift further:

- Y Combinator – insights on what investors expect from founders

- PwC – analysis on why startups struggle to scale

- CB Insights – data-driven breakdowns of startup failure patterns

💡 Final Thought

A great idea opens doors.

Investor-ready documentation keeps them open.

At MP Nerds, we don’t just help founders tell a better story — we help them build one investors can trust.

Because in today’s funding landscape, clarity isn’t optional.

It’s investable.