Artificial Intelligence has rapidly become one of the most powerful tools available to founders. With a few prompts, AI can estimate market size, analyze competitors, generate business models, and even draft pitch decks. On the surface, it feels like validation has never been easier.

But when founders step into real investor conversations, a critical truth quickly emerges:

👉 AI can support validation — but it cannot replace human judgment.

Investors are not funding algorithms.

They are funding decisions, reasoning, accountability, and conviction.

This is where many promising startups stumble — and where MP Nerds plays a decisive role.

The Rise of AI in Idea Validation

There’s no denying the value AI brings to early-stage innovation. Modern AI tools can:

- Scan thousands of market reports in seconds

- Identify competitive patterns across industries

- Simulate pricing models and user personas

- Stress-test assumptions faster than any human team

- Provide rapid feedback on product-market fit signals

According to MIT Technology Review, AI is becoming a standard part of startup experimentation, helping founders move faster and reduce early uncertainty.

But speed and volume do not equal credibility.

The Investor Reality Check

Investors are increasingly AI-literate. Many use AI themselves.

Which means they can instantly recognize when a founder has:

- Copied raw AI outputs

- Presented unverified assumptions

- Confused probability with proof

- Substituted insight with automation

What investors actually look for is interpretation, not information.

They want to understand:

- Why a conclusion was reached

- How assumptions were challenged

- Where risks were identified

- Who is accountable for decisions

- What happens if the model is wrong

This is the difference between AI-generated answers and investor-ready insight.

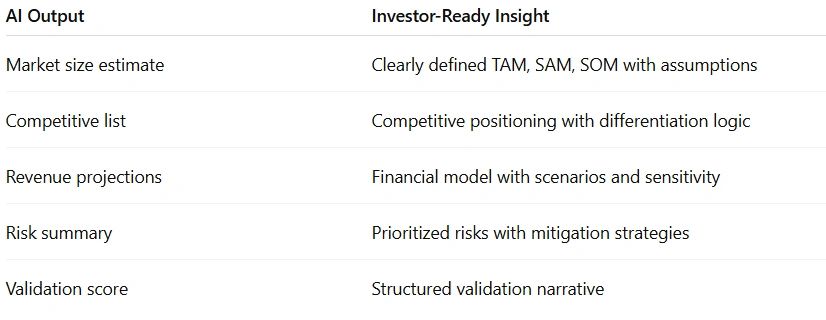

AI Output vs. Investor-Ready Insight

Let’s make the distinction clear:

AI provides raw material.

Investors expect a coherent story.

INVEST: Smart Validation, Not Blind Automation

At MP Nerds, we frame validation through a structured lens we call INVEST — because investors don’t invest in tools; they invest in thinking.

I – Idea Framing

AI helps generate options, but humans define the real problem worth solving.

N – Need & Market Reality

AI identifies trends, but human judgment validates relevance and urgency.

V – Viability Testing

AI simulates scenarios, but founders must choose which risks truly matter.

E – Execution Logic

AI drafts plans, but humans build credible roadmaps.

S – Structure & Storytelling

AI provides data; humans craft narratives investors trust.

T – Transparency & Traceability

AI outputs must be explainable, defendable, and documented.

This approach ensures AI accelerates validation — without replacing responsibility.

Why Investors Still Demand Human Judgment

There is one question investors always ask, implicitly or explicitly:

“If the data changes tomorrow, will this founder know what to do?”

AI cannot answer that.

Only human judgment can.

Investors back founders who demonstrate:

- Critical thinking

- Decision ownership

- Risk awareness

- Adaptive reasoning

- Governance mindset

This is why structure matters as much as speed.

Where MP Nerds Comes In

MP Nerds does not compete with AI — we discipline it.

We use AI as a powerful engine, but always within:

- Clear governance logic

- Structured documentation

- Investor-grade frameworks

- Defendable assumptions

- Human-led interpretation

Our process transforms AI insights into:

- Feasibility studies investors can challenge

- Validation documents investors can trust

- Strategic roadmaps investors can follow

- Risk assessments investors can respect

As highlighted by Gartner, successful AI strategies are not about automation alone — they are about integration, context, and decision clarity.

That is exactly what MP Nerds delivers.

From AI Noise to Investor Confidence

Many founders today have more data than ever — yet struggle to secure funding.

Why?

Because investors are overwhelmed by:

- Over-automated decks

- Unexplained projections

- Shallow validation claims

- AI-driven optimism without accountability

MP Nerds bridges that gap by ensuring every insight is:

- Structured

- Explained

- Documented

- Defendable

- Aligned with investor expectations

The Bottom Line

AI can tell you what might work.

Investors want to know why it should work — and what you’ll do if it doesn’t.

That requires:

- Human judgment

- Structured reasoning

- Clear governance

- Investor-ready documentation

🚀 MP Nerds turns AI-powered ideas into investment-grade realities.

If you’re validating an idea and want investors to take you seriously, don’t just automate — interpret, structure, and lead.

That’s where innovation becomes investable.